Often small businesses try to maintain QuickBooks manual payroll, whether for one person or more than one. This feature enables to track amounts and much more. If you are also seeking for some assistance to turn on manual payroll in QuickBooks, then we are here with this article that will help you in tuning on manual payroll in QuickBooks desktop without any sort of technical glitch.

To know more, make sure to stick around till the end. Or in case you don’t want to perform the steps manually, then you can simply contact our team professionals and let them carry out the necessary procedure on your behalf. Ring up to our team professionals at 1-844-521-0490, and our team will provide you with immediate technical assistance.

You might see also: Reset Password for QuickBooks Admin and other users

Steps to enable Manual payroll in QuickBooks

The most important point is that the QuickBooks software itself enables the payroll feature, but if in case you wish to turn off the feature, then you can follow the manual process.

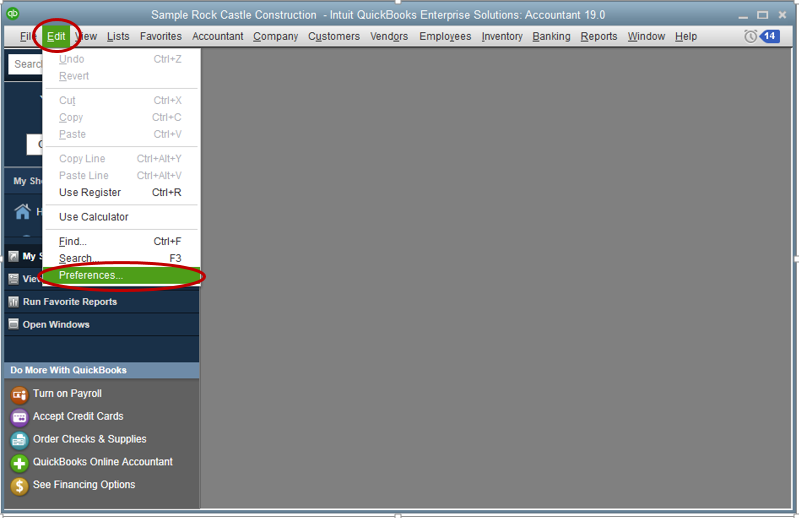

- At first, you are required to select the preferences tab

- Then, from the edit menu click on the payroll and employee option on the left panel

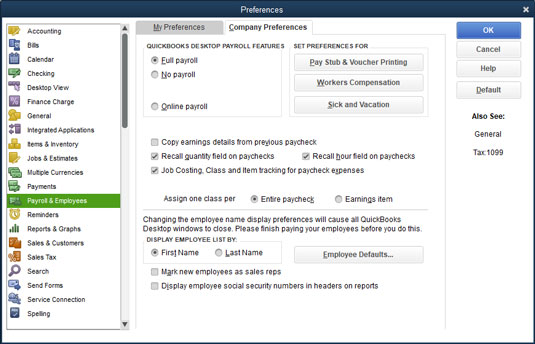

- The next step is to click on the company preferences tab and select the no payroll

- This will help the user to disable the payroll feature

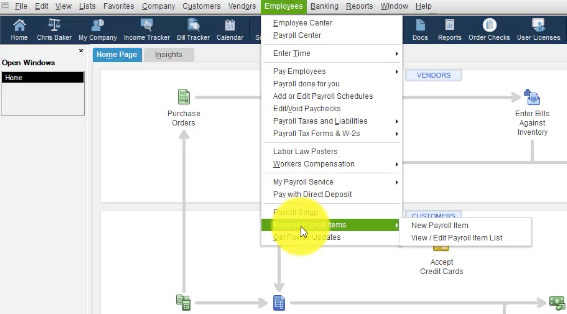

- Now to view the payroll item list, the user is suggested to choose manage payroll items from the employees menu and then select view/edit payroll item list.

- A payroll list looks like any other list with a name and type associated with it would be seen

- The user is then required to add an item and repeat the steps

- The last step is to select the payroll item and select new tab

Steps for calculating payroll, QuickBooks uses tax tables

In order to calculate the payroll, the below steps should be performed:

- Information related to the company: This includes the company name, address and federal tax ID numbers.

- Knowledge about the employees: This means the general information about the employees and information related to payroll.

- Information about the payroll items: This includes company expenses related to payroll.

- Tax tables for federal, state, and local withholdings.

QuickBooks accounting software generally maintains a list of factors that affect the total amount on a payroll check. It also contains every expense of the company which is related to the payroll, also named as payroll item list. For compensating, there are payroll items, taxes, other additions, and deductions, and employer paid expenses. QuickBooks also adds some items to the list for the user, and one can also add others according to the needs. For some common payroll items, like compensation and benefits, QuickBooks offers extra assistance, so that one can set them up. QuickBooks also tracks the payroll liabilities in the payroll liabilities account and the payroll expenses in the payroll expenses in the payroll expenses account.

Read also: How to Set up QuickBooks Workforce for your QuickBooks Desktop?

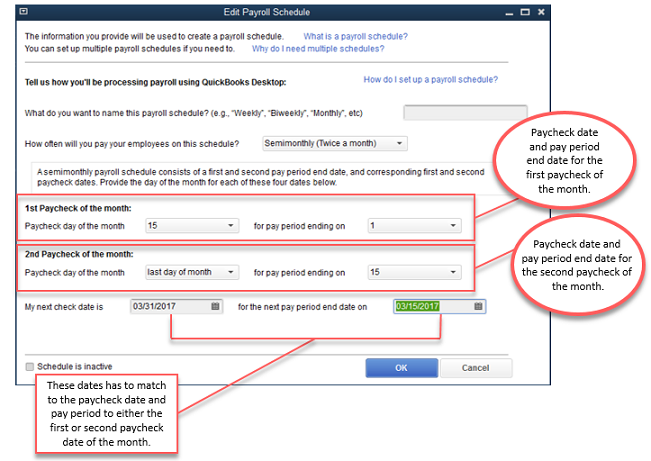

Setting the payroll schedules

You can simply set up payroll schedules to group employees with the same pay frequency be it daily, semi-monthly, bi-weekly, or monthly. It is up to the user, that how often they pay the employees or on which date their paycheck is due, and which day the user wishes to run payroll. QuickBooks usually calculates the upcoming payroll schedule, so that one can pay the employees without any delay. The user is supposed to set up the payroll schedule one time, and assign the payroll schedule to the consulting employees, and then QuickBooks will calculate the due date for each upcoming pay period.

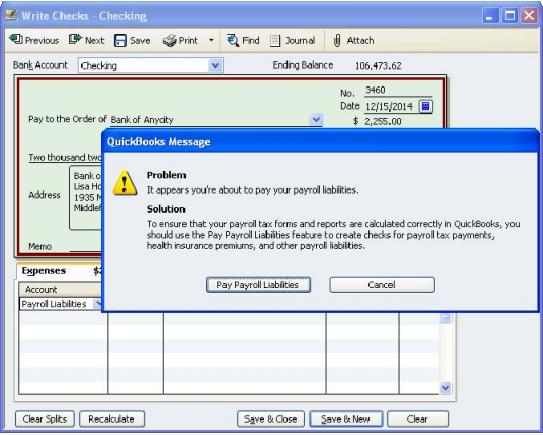

Writing check for payroll taxes

QuickBooks suggests the user for setting up scheduled tax payments for payroll taxes. One can make an unscheduled tax payment, in case an active QuickBooks payroll subscription isn’t available, then a payroll tax present that isn’t set up as a scheduled payment, or an adjustment to payroll tax has to be made. For depositing payroll taxes with the deposit institution, one must make use of the liability check window to fill out a QuickBooks check.

Conclusion

By now, you might be well versed with the process to successfully turn on the manual payroll in QuickBooks desktop. However, if you are unable to perform the steps for some reason, or in case if you need any sort of technical assistance, then in that case contact our QuickBooks enterprise customer support team professionals at 1(844)521-0490. Our experts will ensure to provide you with immediate support services.

More Resources:

How to fix QuickBooks online login problems on chrome?

Fix QuickBooks Cannot Convert your Windows File to a Mac File Problem